- Failure to publish means lenders still being guided by old ‘low risk’ rating

- Lesotho moves from low risk to moderate, while Timor-Leste moves from moderate to low risk

The government of Tanzania has refused the publication of the most recent consultation with the IMF. This means the accompanying Debt Sustainability Assessment has also not been published.

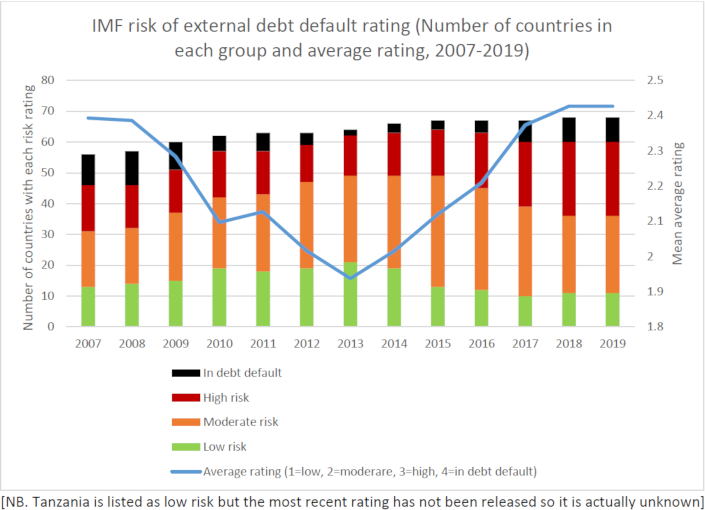

Debt Sustainability Assessments give a rating of low, moderate or high risk of debt default, or in debt default. This assessment is meant to determine how much World Bank and African Development Bank finance is given to the country as grants or loans. It is also meant to guide other lenders such as OECD governments, and China recently committed to using assessments based on the IMF ones. However, the lack of publication means the current Tanzanian risk rating is unknown. Officially Tanzania is still rated as at low risk of debt distress based on the old January 2018 assessment, and this is the rating lenders continue to use.

Furthermore, IMF Debt Sustainability Assessments are an important source of information on debt payments and who debt is owed to. Therefore, the lack of publication is another barrier to transparency.

In changes to ratings which have been published, in April Lesotho moved from low to moderate risk, while in May Timor-Leste moved from moderate to low risk.